Midweek Market Update – Sep 26th

/in Premium /by Bob LoukasApple to Infinity – Sep 22nd

/in Premium /by Bob LoukasMidweek Market Update – Sep 19th

/in Premium /by Bob LoukasBubbles, Bubbles Everywhere – Public Version – Sep 15th

/in Public /by Bob LoukasCYCLES ANALYSIS

GOLD – Cycle Counts

|

Cycle |

Count |

Observation |

Outlook |

|

Daily |

Day 10 |

Range 24-28 Days |

Neutral |

|

Investor |

Week 18 |

Range 18-22 Weeks – 4th Daily Cycle |

Neutral |

|

8Yr |

Month 47 |

Range 90-100 Months |

Bullish |

|

Secular |

Bull |

Gold in a secular Bull Market |

Bullish |

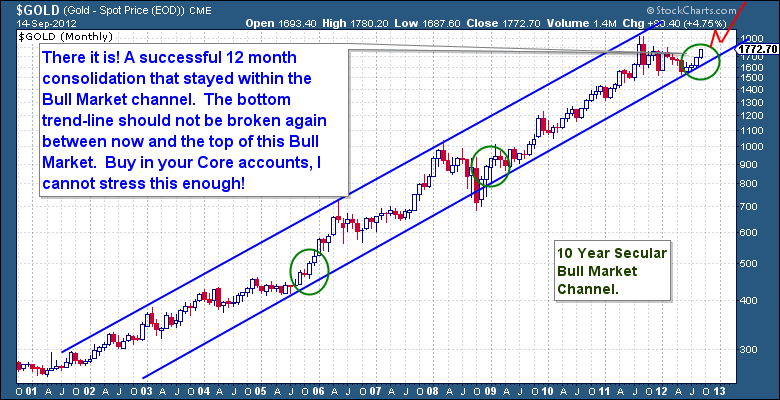

Gold is moving almost vertically now, the pent up energy of a year worth of consolidating is finally starting to lift this asset out of its trading range. The clear realization that the world’s central banks are going to attack their economic problems via monetary expansion and cheap liquidity has ignited Gold again. It has always been the catalyst for this Bull Market since Day 1. But as the central bank stakes are significantly raised, so will fiat money rush into the relatively thinly traded markets of Gold and Silver, guaranteeing that this Bull ends like all others, with a final, massive, and speculative blow off top.

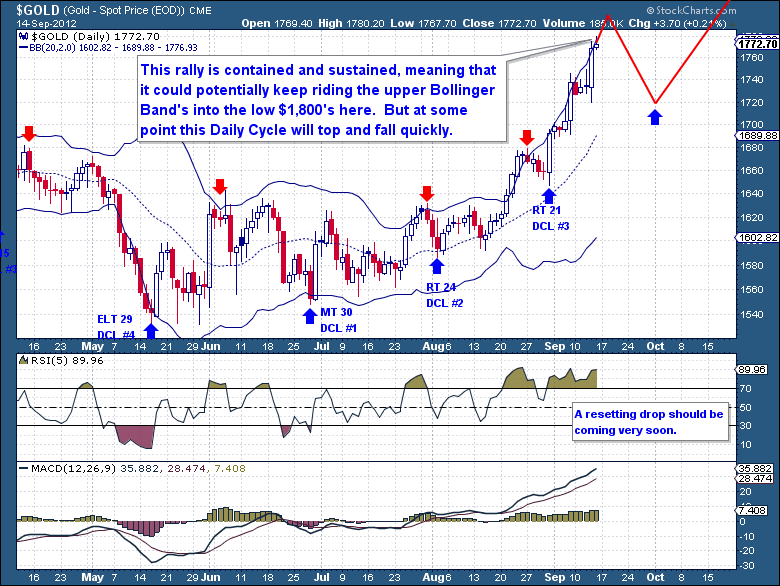

Obviously well before that point though, we need to contend with the immediate price action of Gold. With 17 of 22 winning trading days and a solid $170 surge, the move has been convincing and all confirming. If there was any lingering doubt regarding the future of this Bull Market, then this Gold surge should remove that doubt. But like all significant rallies, we must content and be prepared for the sharp pullbacks too. Although the Daily Cycle (See TERMINOLOGY end of document) is relatively young, it has stretched well above its short term moving averages, is truly overbought in the short term, and is attracting a significant amount of speculative interest. These are short term risks that eventually do have an impact on price. As the Dollar is so severely oversold and due to rebound out of a major Cycle Low, I caution all those who have taken late and much leveraged positions. This type of euphoric move is certainly sustainable, but generally only with a series of short term drops and drawdowns along the way. In an uptrend these are welcomed drops and should not be feared (see trading strategy for current plan).

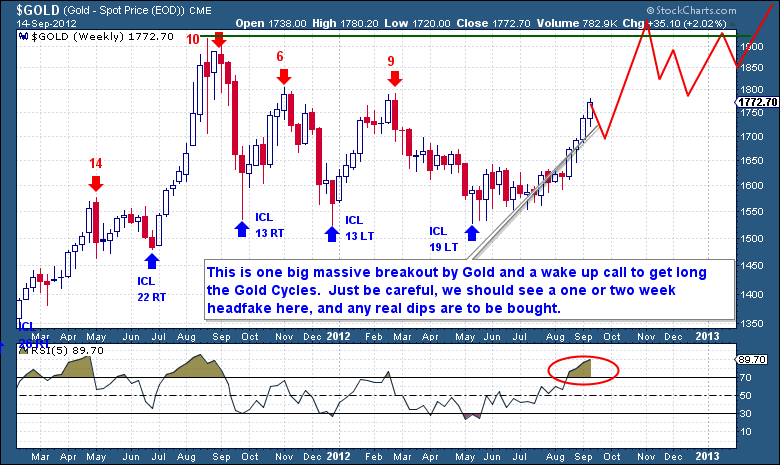

But we’re not necessarily day trading Gold here, we’re trying to catch a significant portion of this Bull Market while avoiding as much of the declines as possible. The Cycle to profit most from is the Investor Cycle and it’s on this chart that the bullish breakout is certainly most visible and inspiring. When we look at the weekly chart, it’s pretty much all open air above from this point. All of the speculative and longer term excess of last years blow-off has been washed away with that fairly demoralizing yearlong consolidation. There was a point not long ago when everybody was predicting sub $1,500 gold, even many of the ardent Gold bugs were running scared and talking about a deeper contraction. This has only served to create the necessary foundation for the next rally.

So with 4 solid winning weeks behind this Cycle, it’s more than clear gold has convincingly broken out. The Aug 2011 blow-off top collapsed and eventually found its D-Wave low at the end of December. The ensuing rally over Jan/Feb was the powerful A-Wave advance and it took most people by surprise. Like all Bull Markets, speculators with still relatively fresh and fond memories of the Aug blow-off were quickly fooled into thinking that was the real deal move. But the move back down (B-Wave) in May to test and hold the D-wave lows was the ultimate insult, serving the purpose of completely washing away all remaining speculative and greed based elements from the asset. In its wake it left behind those wise enough to build themselves core positions in preparation for the next move.

So the coming moves are obvious to me, just like all past C-Wave moves of this Bull Market, Gold is going to first spend the next few months getting back to and likely above its prior highs. Although short term sentiment has risen very sharply, Gold has relatively no trapped longs to contend with and should now be equipped with a loyal and solid base of investors. This foundation will serve as the platform from where gold assaults the prior highs and most likely attempt to crack the $2,000 level.

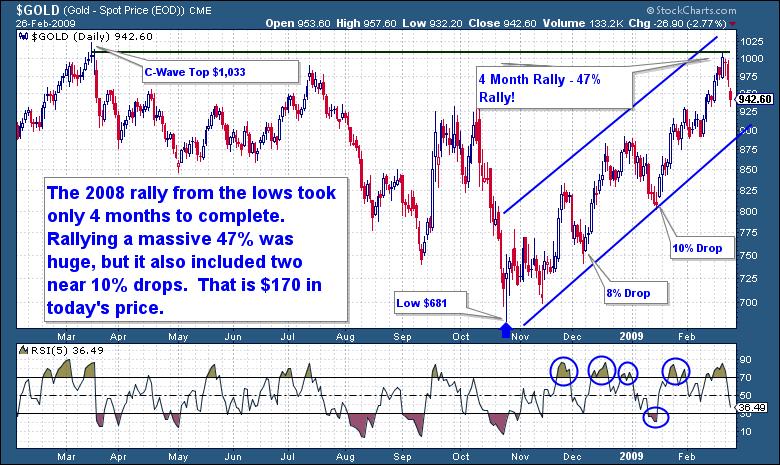

But just like the Daily Cycle warning earlier, we need to be prepared. In any environment, even one as bullish as this, there are always pullbacks. The greater the rally, the sharper and faster the pullbacks will come. This is a natural reaction in any sustained and powerful rally; in powerful moves you see lock-out like gains interrupted by brief periods of stampeding panic for the exits. Don’t forget that out of the 2008 lows the FED pumped in $1T via QE1, the effect on gold was immediate and massive (see chart below). The ensuing 47% rally was simply breathtaking but difficult to ride, but it too was not a straight ride up. So be prepared and do not be surprised with any 5 day, $100 drops. I bring this up not to keep you from getting into positions here, but to prepare psychologically and emotionally. The last thing you need is to panic and sell a strong hand right before a significant turn; rather you should be conditioned to instead buy the dip aggressively.

Investor Tip – Always prepare yourself mentally and emotionally for what may be lying ahead in any given trading situation. Understanding the possible scenarios and their likely impact on your investments will prepare you to emotionally handle the real-time action. Many investors can accurately forecast a coming move; unfortunately it’s their lack of emotional and mental preparation and control that fails them during the panic filled capitulation sell-offs.

Investor Tip – Always prepare yourself mentally and emotionally for what may be lying ahead in any given trading situation. Understanding the possible scenarios and their likely impact on your investments will prepare you to emotionally handle the real-time action. Many investors can accurately forecast a coming move; unfortunately it’s their lack of emotional and mental preparation and control that fails them during the panic filled capitulation sell-offs.

Let me again (as I often do) remind you of the end goal here. We’re investing in a generational Bull Market here, so let’s keep an eye on our prize and walk away from this Bull Market wealthy beyond any expectation. As they say, “there is no fever like Gold Fever”. By the time this Bull Market blows-off, our positions would have multiplied many times over.

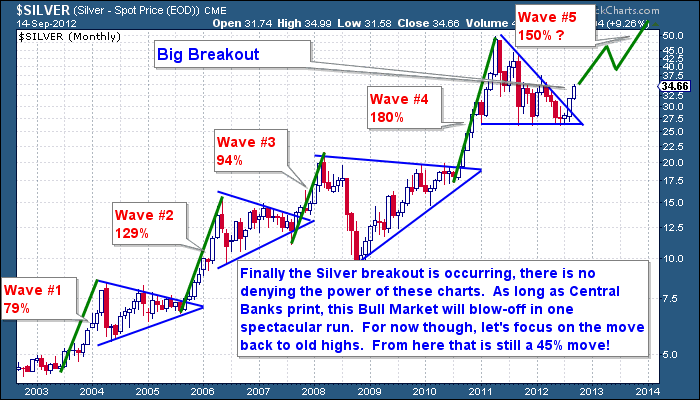

Let’s also not forget our shiny Silver friend in this equation. As you know the Long Wealth Portfolio is loaded with Silver exposure and I’ve been trying to convince you to buy it since the multiple bounces off the $26 area. Members, Silver Wave #5 is going to happen, and to think that Wave #5 does not begin until we get back to $45-$50. Between now and then, we still have a solid 45% move left in Silver just to get back to the prior highs. This is exciting and you need to ensure you are adequately and correctly exposed to Silver.

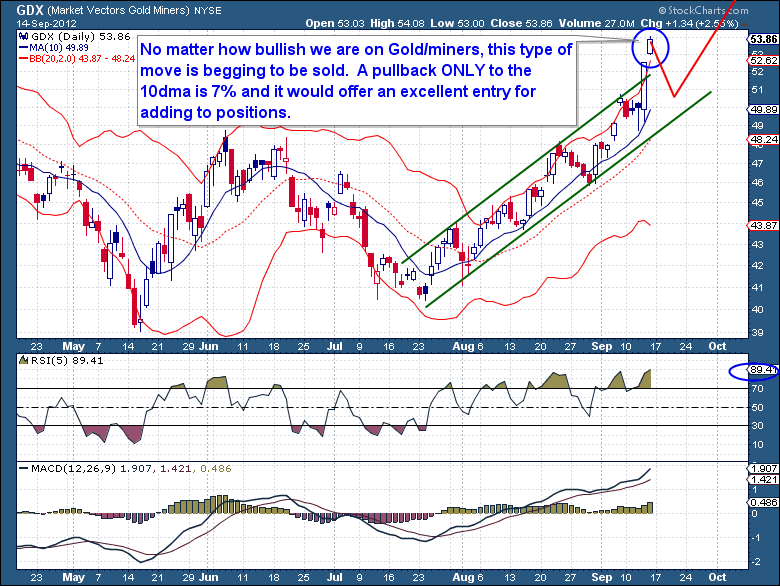

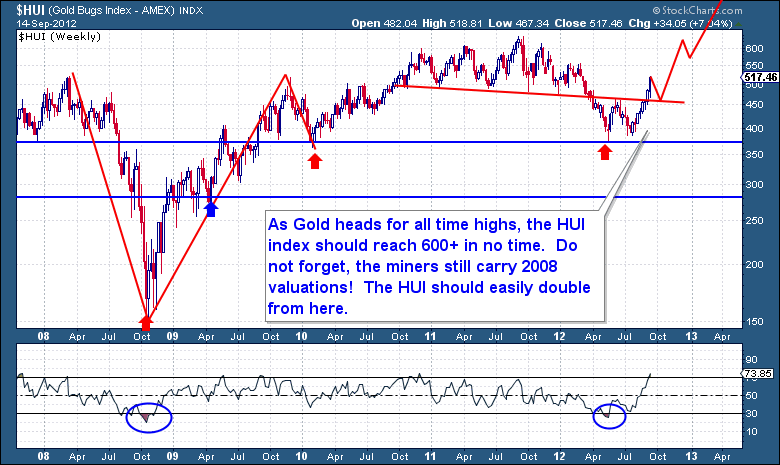

Moving along to miners, I’ve got to admit I have neglected them in preference to metals in this early move, and it has been somewhat of a mistake. The reasoning has simply been that the metal generally needs to make its sustained move before the mining sector follows suit. Without a strong supporting bullion price, the miners are not going anywhere in a hurry. GDX and the mining complex in general has seen a very powerful move here, one that has been beyond impressive considering the relative infancy of this latest Gold move. For me this gives me confidence and is simply just more confirmation that the Bull Market in Gold is squarely back on the table and about to enter mainstream.

Since the successful retest of the May lows, GDX has gone on to rally 30% off these lows. Just like Gold, this move has “plenty of legs” for the long haul, but in the short term it has gotten slightly ahead of itself here. The latest spike on Friday pushed GDX fully above the upper and stretched Bollinger Bands, well clear of its defined channel, and a full 7% above just its 10dma. Such an extreme move is only ever sustainable in the final stages of any blow-off move, so I fully expect that by early next week we see at least the start of a sideways retracement. But we must realistically (and hope for the Bull’s sake) expect to see at least a 5% drop back to the 10dma before the move could reset itself again. Even a $5 drop over 2 weeks to the middle of the band would be beneficial for the miners; it would set the scene for another strong surging rally.

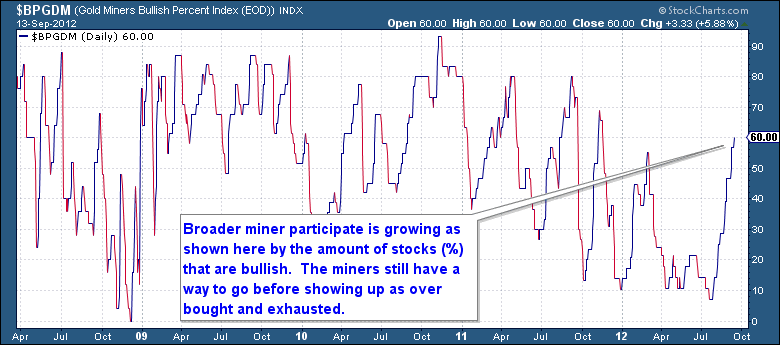

From an exhaustion standpoint, this rally still has plenty of sidelined miners who have yet to join in. Although the rally is broadening, only 60% of miners are in a bullish up trending pattern, suggesting that after a quick pullback, the miners could go on to repeat yet another 30% rally!

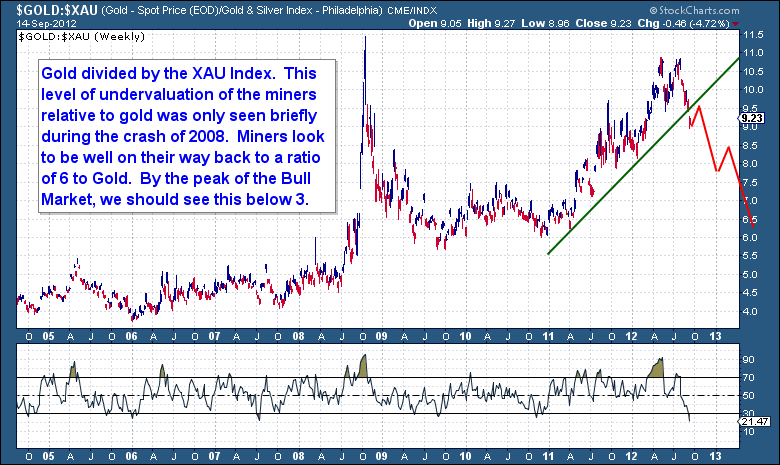

In terms of rotation, it looks as if the miners may have turned the corner here. Essentially ever since the last real run in the miners ended in 2010, they have spent a solid 18 months greatly underperforming the metal. The ratio of Gold to the XAU index basically doubled, clearly illustrating that the miners have spent more than 18 months consolidating in preparation for this new move higher. As the ratio begins to fall, the miners will be increasing in price at an accelerated ratio compared to Gold. The argument for rebalancing the Investor Portfolio weighting between the metals versus the miners is certainly going to be something we will be addressing (See trading section).

From a longer term perspective, the under-performance of the miners is glaring. With prices still no higher than where they were 4 years ago, the potential for massive gains in the near future can easily be seen through the below chart. With a clean and decisive break of the 18 month consolidating trend-line firmly behind us, there remains the potential for one last drawn down to kiss the trend-line before exploding higher. But even from this point, a move back to the prior highs is still a 20% gain. Once gold begins to make new all-time highs the miners should be well on their way to outright doubling in price.

I hope by now you have released just how difficult it is to trades big bull markets. Getting in and out of positions is not going to be easy. Sometimes we will nail the exact low and highs of a given Cycle, but then at times it will completely run away from us. That is the nature of “trading”, it’s not easy and not for everybody. Until we get back into clean and predictable C-Wave Cycles, do not underestimate the power of buying and holding positions here.

Trading Strategy – Gold/Silver

MEMBER ONLY SECTION. CONSIDER A FREE TRIAL TO "THE FINANCIAL TAP". IT'S 100% OBLIGATION FREE, CLICK ONTO THE "FREE TRIAL" BUTTON ABOVE.

Equities (S&P500) – Cycle Counts

|

Cycle |

Count |

Observation |

Outlook |

|

Daily |

Day 9 |

Range 36-42 Days |

Bullish |

|

Investor |

Week 15 |

Range 18-22 Weeks – 3rd Daily Cycle |

Neutral |

|

4Yr |

Month 40 |

Range 44-52 Months- 8th Investor Cycle. |

Bearish |

|

Secular |

Bear |

Equities are in a secular bear market |

Bearish |

Equities are unstoppable; the rally that everybody “supposedly” hated is now loved by all. I’ve got to admit that my bearish expectations have not materialized at this point. This purely because I’m a top-down analyst, somebody that likes to focus on the macro (high level) picture which is used to frame the Secular and Investor Cycles outlook. Let’s be clear though, my views on the macroeconomic landscape have not waivered, the global macro and now micro fundamentals are horrible; there is no logical argument to dispute this. What we’re seeing here in my opinion is simply the final speculative phase of a Cyclical Bull market that is being kept alive by artificial and unconventional means.

Don’t let the QE’s, “media headlines”, and Equity rallies distort you from the realities of what is happening with the fundamentals. The FED will have you believe that they can alter, even avert the coming business Cycle contraction. This viewpoint is simply a front to the reality of what is occurring here. As the banks continue to lose on the assets and derivatives they hold, the FED is going to make them whole again as the economy slides into yet another deep and protracted recession.

The data out of Europe is simply horrendous, and I’m not talking about the peripheral club-med nations only. The core, the industrial German super-power, is now contracting at an alarming rate. The US too is contracting; ISM numbers have shown contraction for 3 straight months while the employment picture shows a disillusioned workforce exiting in droves. We don’t even have employment growth to sustain population growth, let alone the long term unemployed. China is also slowing quickly and it’s having an impact on the raw industrial metals and the economies of the resource heavy nations like Canada and Australia. Essentially the world is already in a world-wide recession and the main stream media don’t give it a second of air-play. But the FED certainly already knows this; it’s why Ben “Bazooka” Bernanke came out blazing this week with a program that was huge, over the top, and very bold. There were 4 surprises in his announcement, open ended purchases, extension of ZIRP (zero interest rates), extension of Twist and new outright MBS purchases. This round of QE was extreme and I don’t doubt for a second that the short to intermediate term effects of this liquidity and associated euphoria will push risk assets to new highs.

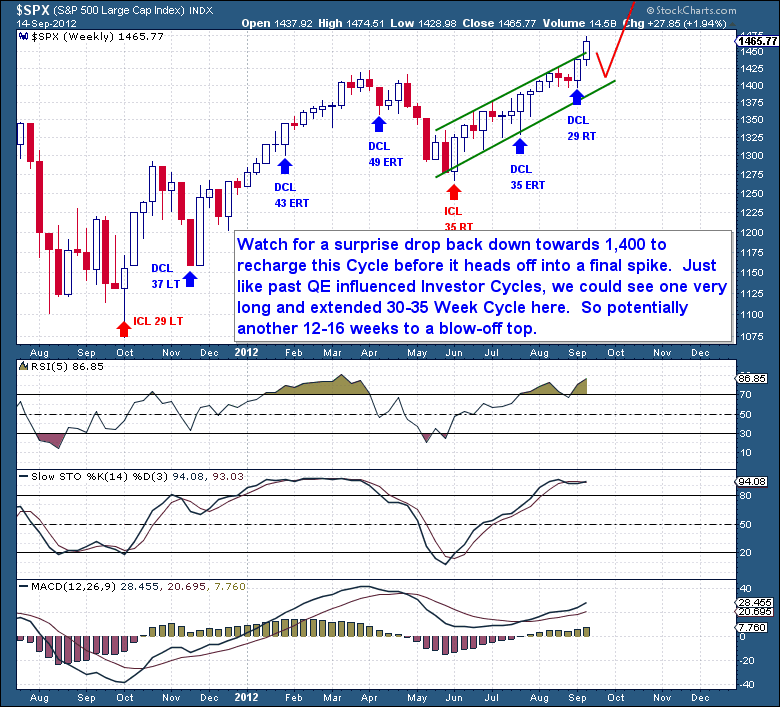

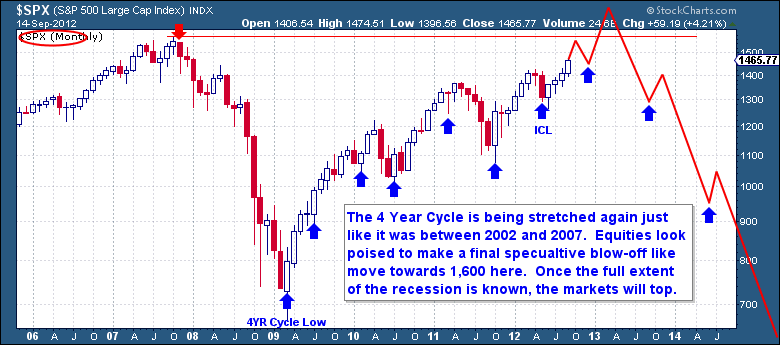

I really couldn’t tell you what is going to happen in the short term. But I will say that this version of QE simply blew away all expectations and is just far too powerful and influencing to ignore. I now believe that this program is going to send the already grossly overvalued equity markets into a speculative frenzy. Put like past FED action, it will only end in another classic bubble bursting. Like past QE influenced Investor Cycles, this one could become extremely stretched, possibly another 35 week cycle that ends in the early New Year. An over extended may come in the form of a blow-off top like move, a final grand finale.

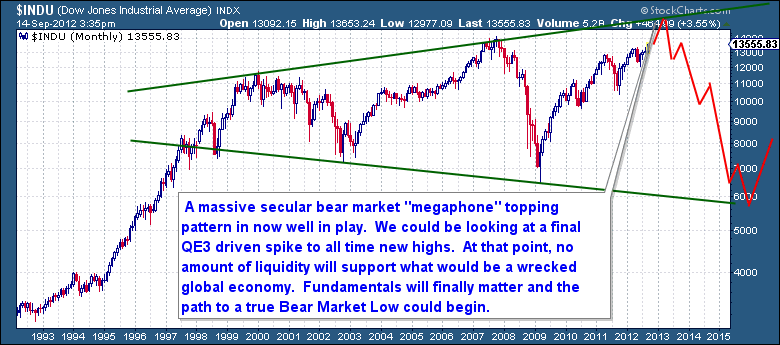

This speculative move beyond the prior highs would see equities near the 1,600 level, a height that will seem ridiculously outrageous once the true picture of the fundamentals is made clear. The FED would have succeeded in driving another speculative bubble to heights that will not be supported or sustainable under any given amount of new or promised QE. It’s at that point the stretched 4 Year Cycle should top, ushering in a series of declining Investor Cycles that ends in a demoralizing generational Bear Market Low.

When all is said and done, Equities would have mapped out a massive 15 year megaphone topping pattern that ends is one of the most disheartening lows recorded. The collapse will wipe out whatever gains (and plenty of the capital) that ordinary workers managed to recover from the last fleecing in 2008. As the final retail crowds come screaming back into the market in hopes of capturing these “easy gains”, they will be the perfect subjects for smart money to unload their shares. This destruction of wealth on the lower and middle classes, in addition to the 10 year sub-par jobs market and year over year falling real incomes will serve as the foundation for the next great economic reset.

Trading Strategy – Equities (S&P500)

MEMBER ONLY SECTION. CONSIDER A FREE TRIAL TO "THE FINANCIAL TAP". IT'S 100% OBLIGATION FREE, CLICK ONTO THE "FREE TRIAL" BUTTON ABOVE.

$US DOLLAR – Cycle Counts

|

Cycle |

Count |

Observation |

Outlook |

|

Daily |

Day 15 |

Range 18-22 Days – 5th Daily Cycle |

Bearish |

|

Investor |

Week 21 |

Range 18-22 Weeks |

Bearish |

|

3Yr |

Month 16 |

Range 36-42 – 3rd Investor Cycle. |

Neutral |

|

Secular |

|

The Dollar Secular Cycle is undetermined |

Neutral |

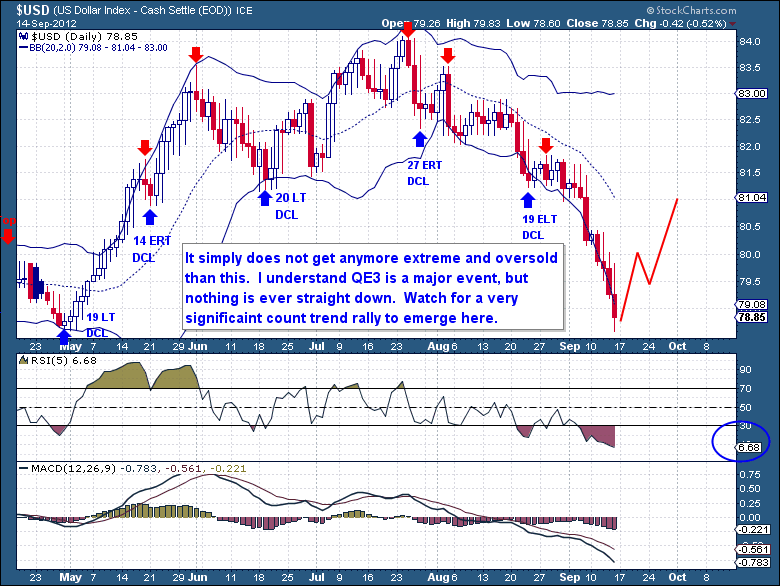

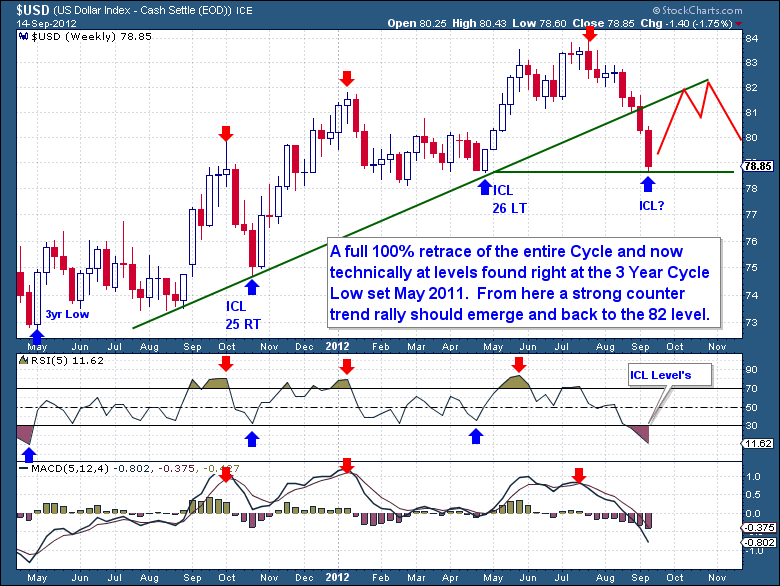

The Dollar sure has taken a real beating here. With blood in the water, the shorts have encircled from every conceivable angle. It’s not in the least surprising of course; the Federal Reserve has essentially taken the baton and sprinted ahead of every other central bank. In a race to provide desperate liquidity and to devalue their currency faster, the FED seems to have surprised their fellow bankers with the scope of this (QE3) action. Every economy is hurting and a lack of jobs growth is a real social and political issue. Right or wrong, the ruling Keynesian establishments are responding as they know best. So it’s not at all surprising here to see the Dollar drop, especially as it was already well in the timing band for a significant move towards an ICL.

But wait a minute, I know the FED’s easing was huge and the selling was expected. But this drop is off the scales (short term) in size and scope, in fact almost unprecedented (for the Dollar) in its intensity. The bet against the Dollar has already become the single most one sided trade out there. Whether it’s now or a few days away I don’t know, but there is a very high probability that we’re about to see a Dollar Daily Cycle Low.

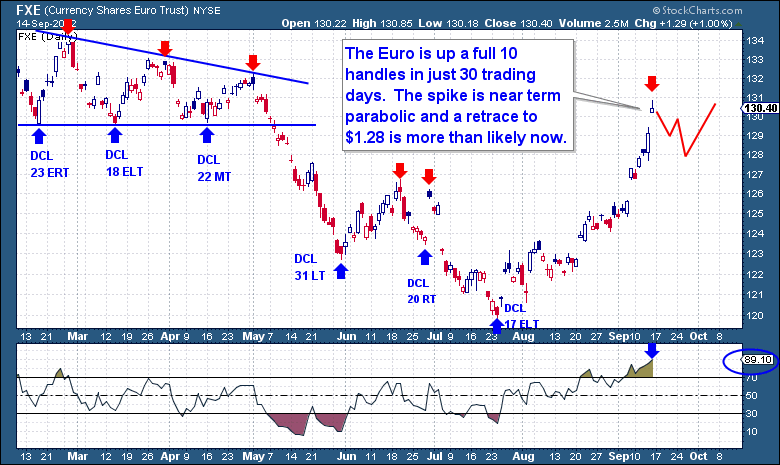

Across the pond, the already accommodating ECB must be in total shock and denial. Here they have a mandate to stimulate growth and employment, but sit and watch as the American’s trump their recent liquidity initiatives with a much broader and larger unconventional policy. In response, they have seen their currency appreciate a full 10 handles within 30 trading days, a headwind which every European exporter could certainly do without.

But like the Dollar, the move in the Euro is grossly overplayed here, especially when you consider the structural problems and poor economic health of the Euro block. The need to fund the European sovereign states from a common central bank is an almost given at this point. It won’t be long before the European’s, British, and Japanese begin to formulate their own plans in response here. There is no way that these export starved nations are going to allow the US to simply print their way out of trouble at their own expense.

The all-important Investor Cycle has fallen for 4 straight weeks now, the first such occurrence during this current 3 Year Cycle. Typically such losing streaks are reserved for the 2nd half or declining phase of any given Cycle, so it’s an interesting development at this point. The Cycle came very close to a failed state, basically retesting the last Investor Cycle Low set in May. This full 100% retrace of an Investor Cycle was certainly not expected just a month ago, but as long as it remains above the May highs, it has the potential to move higher in the coming weeks under the strength of a new Investor Cycle.

But the action is not convincing or promising, and the weakness here could well be foretelling that the Dollar has topped and the long process of declining to a 3 Year Low has started. On the surface this should be an easy call to make here with the FED’s new QE3 program. But it’s not that straight forward. Do not forget that the Dollar remains above the level where QE1, QE2, and Operation twist were announced. We’re also in a severe process of deleveraging and asset destruction, so a good portion of the FED’s actions are being naturally sterilized. There is also the fact that the Dollar, like all currencies (except the Swiss to a small extent) are “fiat currencies”. Meaning they are simply a piece of paper, and IOU that are created without any backing, they can print as much as they like. So as U.S centric investors fret over the Federal Reserve’s actions, do not lose sight of the massive levels of worldwide central bank easing that is occurring today. The ECB, China, Japan, and the UK have all expanded their balance sheets over the past 5 years at an almost even pace. Remember, currencies are conveniently expressed (priced) in terms of pairs, one fiat currency versus another. If both are severely debased together, they could to the credulous public provide the illusion of both being stable currencies.

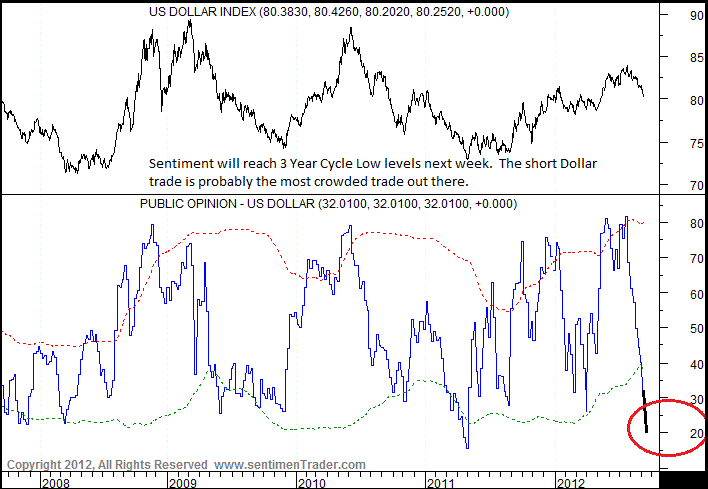

So although the intermediate picture for the Dollar is not pretty, the asset is due for at least a significant counter trend rally here. Much of the move down this past month was because of QE3 expectations, and since the announcement the drop has turned into complete capitulation. But it’s normally at these extreme one-side sentiment moves that all sharp counter trend rallies are born. Just as sentiment has reached fever pitch levels amongst all risk assets, I believe we will be reminded shortly that trading and investing is never just one way street.

(Sentiment chart from Tuesday. Added to the line to reflect likely sentiment at current levels).

$US DOLLAR – Trading Strategy

MEMBER ONLY SECTION. CONSIDER A FREE TRIAL TO "THE FINANCIAL TAP". IT'S 100% OBLIGATION FREE, CLICK ONTO THE "FREE TRIAL" BUTTON ABOVE.

TERMINOLOGY

Cycles

Much of nature and mankind's actions move in definable, predictable cycles. Whether that be the seasons, the planets, war's or our cycle of sleep. In the marketplace, cycles of varying lengths influence the price of securities, they track the ebb and flow of human emotion and its effect on price. The studies of cycles are a powerful analytical trading tool that can give investors an edge, allowing them to get a jump start on trends and trend reversals. One complete cycle is measured from two low points, the start and the end of the cycle. A number of daily cycles make up one Investor Cycle and a number of Investor Cycles make up one longer term cycle, like the often quoted 4yr year Equities cycle. Picture the cycles being intertwined with the long duration cycles greatly influencing the outcome of the next shorter duration cycle. Understanding the likely movement of a longer term cycle provides us with the framework to better predict the short duration cycle we trade within.

Daily Cycle (DC)

The shortest cycle I track (although shorter cycles exist) which are measured in trading days. A typical Gold and Dollar cycle will run for 16-22 days while an equities cycle will run for 36-42 days.

Daily Cycle Low (DCL)

The DCL is the low point of the cycle which marks the end of one daily cycle and the beginning of the next cycle. Understanding when the low is expected is critical to successful cycle trading.

Investor Cycle (IC)

The Investor Cycle is measured in weeks and I consider it to be the most important cycle. The movements and flows of the Investor Cycle are much more consistent and provide a long enough time frame to allow "investors" to take position without having to manage it on a daily basis or have to stress about the short term daily whipsawing volatility. It affords us the opportunity to obtain excellent returns. The Gold, Dollar and Equities Investor Cycles average from 16-22 weeks in duration.

Investor Cycle Low (ICL)

The ICL is the low point of the cycle which marks the end of one Investor Cycle and the beginning of the next cycle. Understanding when the low is expected is critical to successful cycle trading.

Left & Right Translation – (LT or RT)

Any given cycle is measured from the two lowest points, the start and end of the cycle. The highest price point of the cycle is the Cycle Top. Using these 3 price points, we're able to draw a picture of the cycle from low to top to low, a bell curve of sorts. So where the top of the cycle occurs determines if the cycle is Left Translated or Right Translated. For example, if a Daily Cycle runs for 22 days, from low to low, then the middle of the cycle is day 11 (22 divide 2). If the highest point of the cycle occurs before day 11, then that cycle is a Left Translated Cycle (Top is left of middle). If the highest point occurs after day 11, it is Right Translated (Top is right of middle). Why is this important? The translation tells us if the cycle spent more time rising or falling. As the cycle moves to the top, price is generally rising. As the cycle moves towards its low, price is generally falling. So to expect a Left Translated cycles is to expect a cycle that rises less than it falls in price. Opposite is true in Right Translated cycles, we expect price to be rising more often than it is falling. With an expected Translation in mind, we're able to better predict the starting and ending price performance of any given cycle.